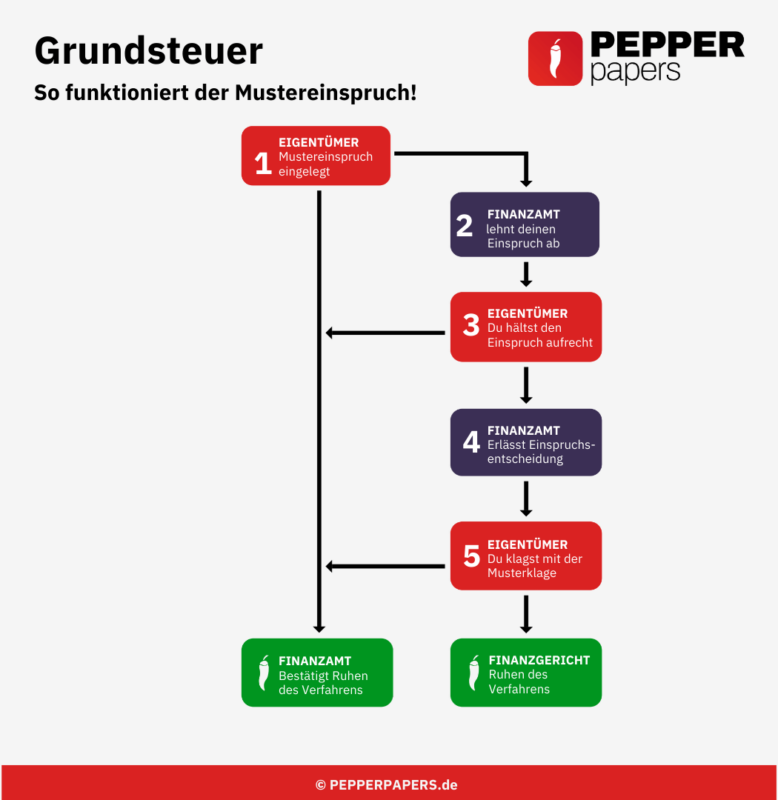

Property tax 2023: How the model objection works!

Have you submitted your property tax return and received property tax assessments from the tax office? Now you have one month to lodge an objection.

We’ll show you what you need to do and how the rest of the process works.

The aim of the objection is for the tax office to suspend your proceedings until a decision has been made on the legality of the property tax. To this end, several test cases are currently before the tax courts.

The following procedure will show you what you can do and how the tax office reacts in our experience:

1. the tax assessment notice has arrived

You make the sample objection to the tax assessment. This will ensure that the notice does not become legally binding. You can find the PepperPaper here: Property tax tax office sample objection 2023

2. tax office rejects your objection

There are two ways in which the tax office can react to your objection.

The tax office puts your proceedings on hold. Then you have already achieved your goal here.

The tax office rejects your objection. (Important: The tax office often writes that the objection is unfounded and that you should withdraw the objection. The tax office does not explain the figures in the tax assessment notice to you in such a way that you understand them. This is a mistake on the part of the tax office).

3. you stick to your objection

If the tax office rejects your objection, you must pursue it further. You have the opportunity to do this with our PepperPaper: Property tax tax office continues to contest, the tax office does not explain the figures so that you understand them

4. the tax office makes the objection decision

The tax office will now decide on your objection in writing. Here, too, there are two ways in which the tax office decides.

Either it lets the proceedings rest. Then you have achieved your goal.

Or the tax office rejects your objection.

5. your complaint

You can appeal against this to the tax court. You have one month to do so. You can take legal action without a lawyer and without a court hearing.

Get our PepperPaper property tax sample lawsuit 2023.

6 The court case

However, if the tax court rejects the claim, you have further options in the next instance at the Federal Fiscal Court. We will discuss this in another blog post.

As you can see, the process seems very complicated. But it is very simple with our PepperPapers legal documents.

If you have missed the objection deadline, the path to your goal is more complicated. Find out more in our blog post: Property tax 2023: Missed the deadline? Here’s what happens next!