Property tax 2023: Missed the deadline? Here’s what happens next!

Have you submitted your property tax return and already received the property tax assessment notices from the tax office? Have you missed the objection deadline, which expires one month after notification?

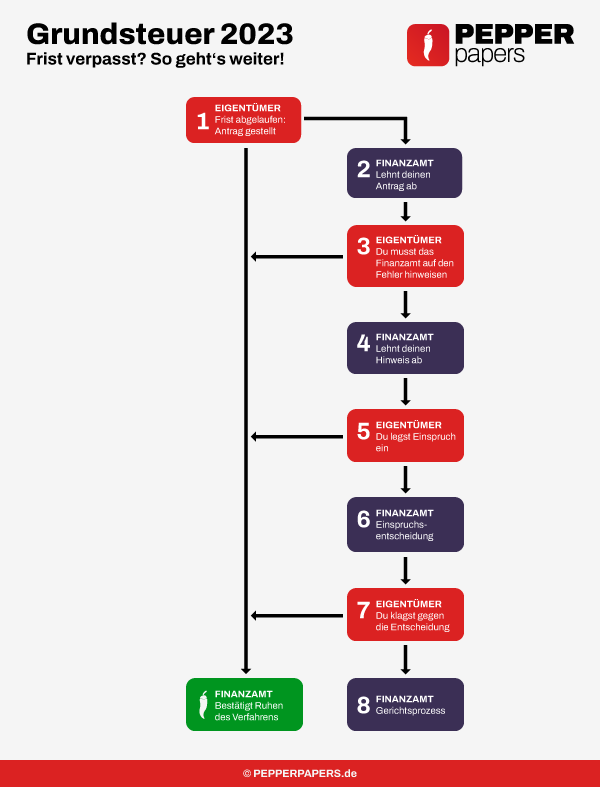

We’ll show you what you can do now and how the process works.

You probably want to know what the aim of all this is! It’s quite simple! The tax office should put your proceedings on hold until a decision has been made on the legality of the property tax. However, if you have missed the objection deadline, the path to your goal is more complicated. The following procedure will show you what you can do and how the tax office reacts in our experience:

1st deadline expired: Application submitted

You submit an application to the tax office. You can find the PepperPaper here: Contesting property tax with the tax office even though the deadline for the objection has expired

2. tax office rejects your application

There are two ways in which the tax office can react to your application.

- The tax office puts your proceedings on hold. Then you have already achieved your goal here.

- The tax office rejects your application. (Important: The tax office often writes that the deadline for the objection has been missed and that it rejects your objection. This is not an objection. This is a mistake on the part of the tax office).

3. notification of errors to the tax office

If the tax office rejects your application, you must inform them of the error. You can do this with our PepperPaper: The tax office won’t process your property tax application

4. tax office rejects your tip

Now there are two more ways for the tax office to decide on your PepperPaper.

- The tax office puts your proceedings on hold. Then you have achieved your goal.

- The tax office rejects your application. (Important: You have the option of lodging an objection from this point on).

5. objection

If the tax office has rejected your application, you can now lodge an objection within one month. The PepperPaper for this is called: Challenging property tax from the tax office, the deadline for the objection has expired – but the tax office rejects your application

6. appeal decision

This means that you are now in an objection procedure and the tax office can now remedy your objection and your procedure is suspended. Or the tax office will issue an objection decision.

7. lawsuit

You can take legal action against this objection decision before the tax court within one month so that you can have your proceedings suspended. We at TaxPro are already working on the model action for this special procedure. You can file the model action without a lawyer and without a court hearing.

If you receive an objection decision, you can also send it to us anonymously using our contact form. We develop the PepperPapers model complaint together with the feedback from our customers.

8th court case

However, if the tax court rejects the claim, you have further options in the next instance at the Federal Fiscal Court. We will discuss this in another blog post.

As you can see, the path is extensive, but very simple with our PepperPapers legal documents.