The new property tax explained – How to lodge an objection

Oppose the new property tax

With the PepperPapers sample objection

The new property tax affects all property owners in Germany. Around 33 million people are required to submit their property tax return. But this step is just the beginning. Submitting the tax return triggers a process at the tax office that is associated with new difficulties for many owners. The question now is how to deal with the letters from the tax office.

The PepperPapers property tax sample objection

Be your own lawyer with PepperPapers.de

With the sample property tax objection from PepperPapers.de, you can stand up for your rights without a tax consultant or lawyer. With the sample objection, you ensure that your tax assessment remains open, i.e. does not become final. You can take action against an outstanding tax assessment notice with everything that tax law has to offer. Until you receive the tax assessment notice from the municipality in 2025 and – if necessary at a later date – for your lawyer’s tax arguments in court.

Objection! How to use the sample objection to property tax

We help you become an advocate for your own cause

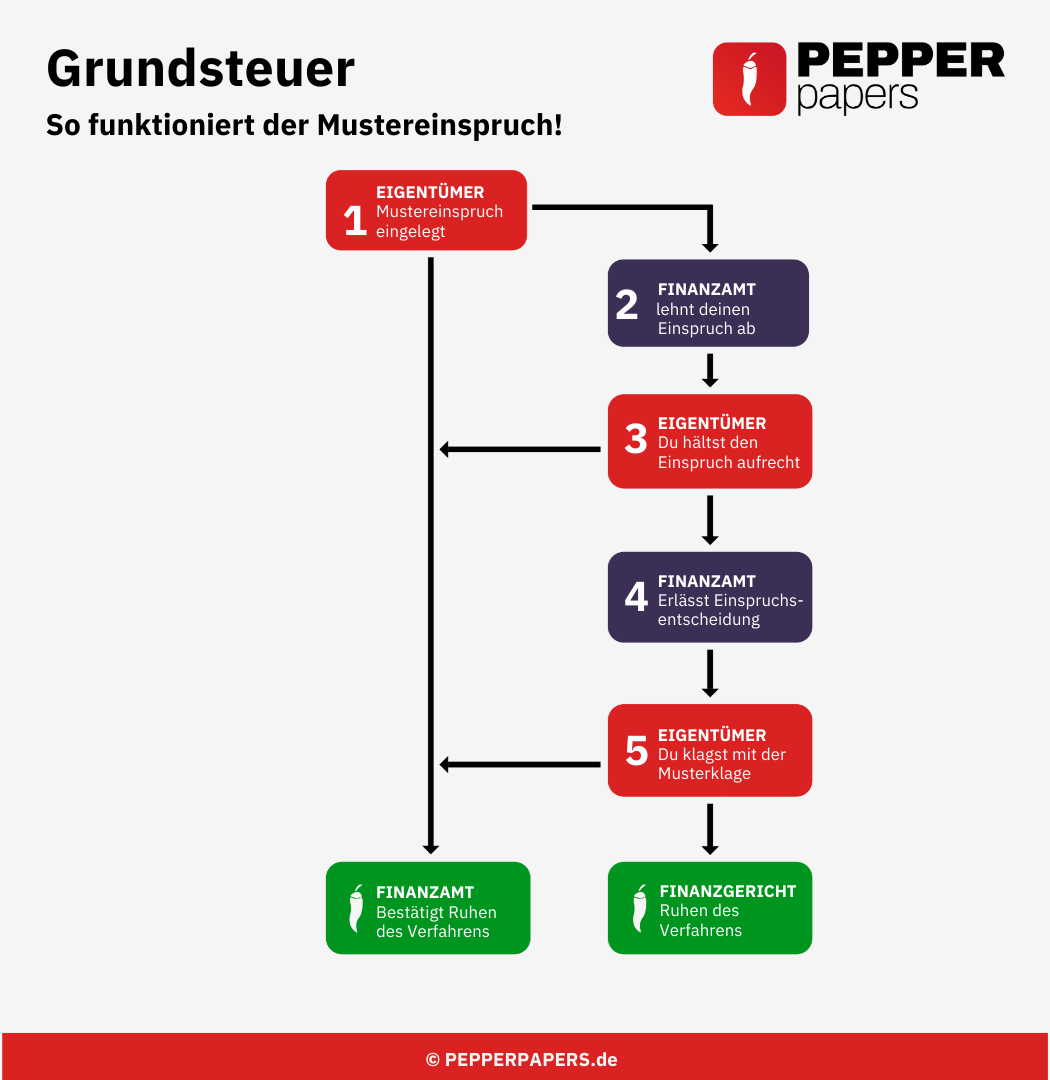

Standing up for your rights is easy with the PepperPapers sample objection. Nevertheless, you should have a basic understanding of what the objection does, how your tax office can react to it and what options you have in response. We have created a roadmap for you to help you easily follow the necessary steps and their exact sequence – without having to study law. If you are still not confident enough to act as a lawyer on your own behalf and have unanswered questions, we will be happy to answer them in an individual consultation.

The PepperPapers property tax model lawsuit

If the tax office rejects your objection

In very rare cases, it can happen that the tax office rejects the property tax objection. Even if you have met all the prescribed deadlines. If this is the case, there is unfortunately no way around taking legal action against your tax office if you want to stand up for your rights. For this rare case, we have designed the PepperPapers property tax sample complaint, which you can file without a lawyer.